Leech Protocol’s Q3 2023 RECAP

Hey, Leechers! It’s been a wild ride so far! A couple of days before the end of Q3 we are ready to share all the important achievements we’ve completed!

Product updates

- First of all, we’ve launched the Beta version of the product with access for the Early Birds campaign participants!

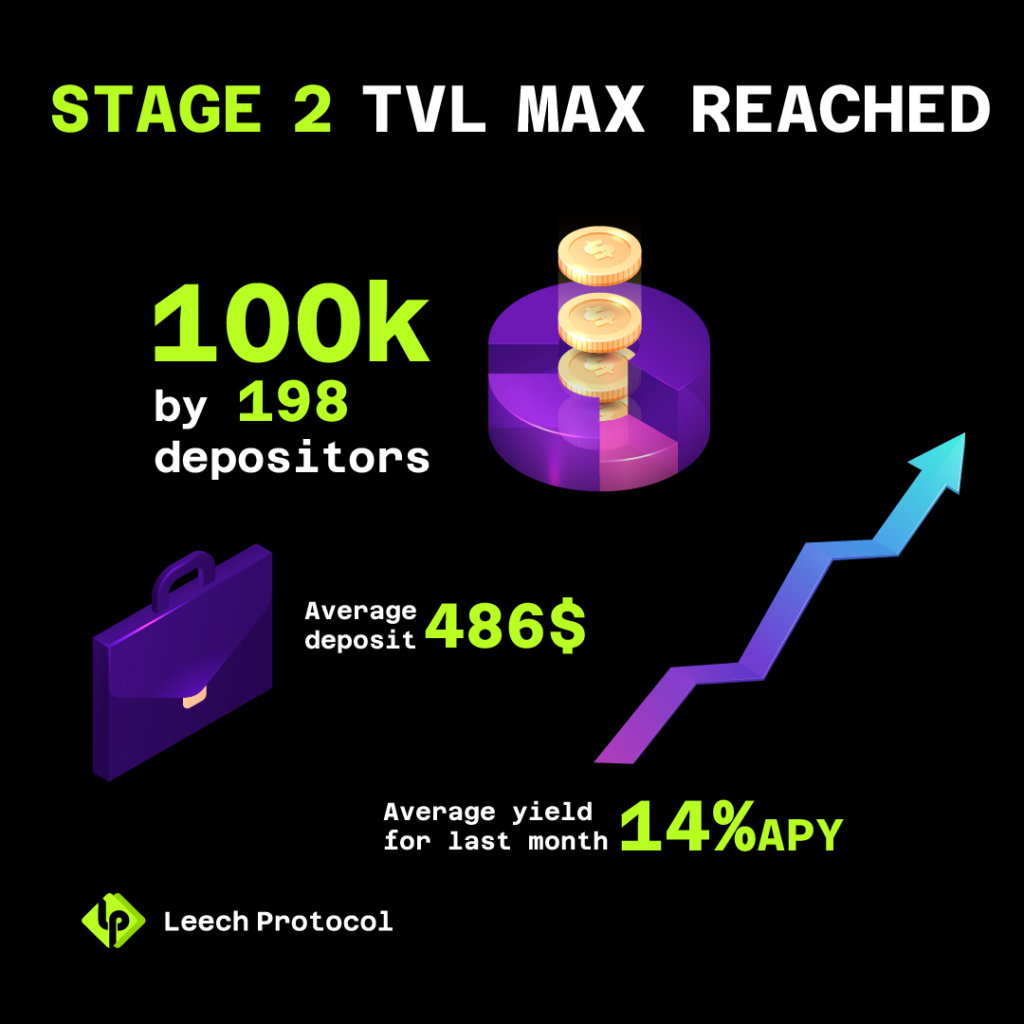

- We’ve achieved our max limit for the 2nd stage of launch – 100K TVL with 198 wallets in 18 days! Per wallet allowance was $20-$3000 and wallets had to be whitelisted via the Galxe campaign and/or our initial WL process.

- The first month’s average yield was ~14%.

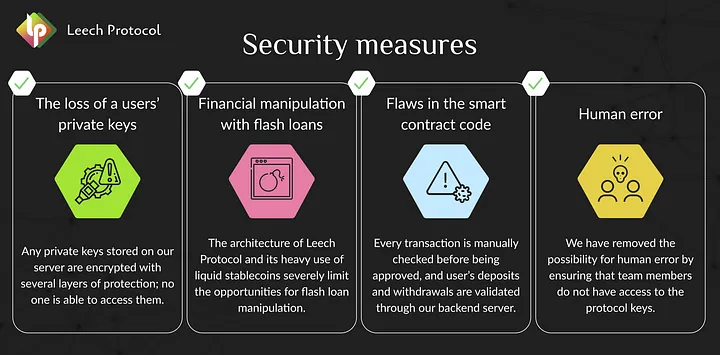

- We have secured 10/10 points with 2nd audit by Hacken. Kudos to our Dev team!

Marketing & Community Updates

- Our Early Birds campaign to provide access to the Beta was quite a success! As of 22 Sept 2023, 7555 wallets joined it!

- We’ve opened an official Debank account and in a short period, ~700 Degens followed us with a whopping ~$30M TVF!

- Our Twitter account grew to almost 40K followers, TG ~ 15K, and Discord ~10k members!

- We have joined the EthCC conference and organized a Yield Farming workshop in Paris! 70 degens and partners joined us for the Beer&Farming conversation about the current state of DeFi and Leech Protocol’s approach to farming!

- We have launched the Yield Farm Academy with the first lesson and AMA session!

New partners and protocols onboard!

- Thena became our latest partner!

- DefiLama started tracking our protocol!

- Several partners are waiting for the official launch to publicly state they support us!

What do we plan to accomplish shortly?

As we build an #easyDeFi product – so priority #1 is our Mixed Pools. We will add more pools and protocols to our automated farming algorithms! The process is quite simple:

1️⃣ A user provides liquidity via App

2️⃣ Algorithm search for best APRs

3️⃣ Liquidity goes to connected pools, according to the chosen RISK Level

4️⃣ The user enjoys non-stop yields

5️⃣ If APR goes down – repeat 2️⃣

6️⃣ Withdraw is available at any moment!

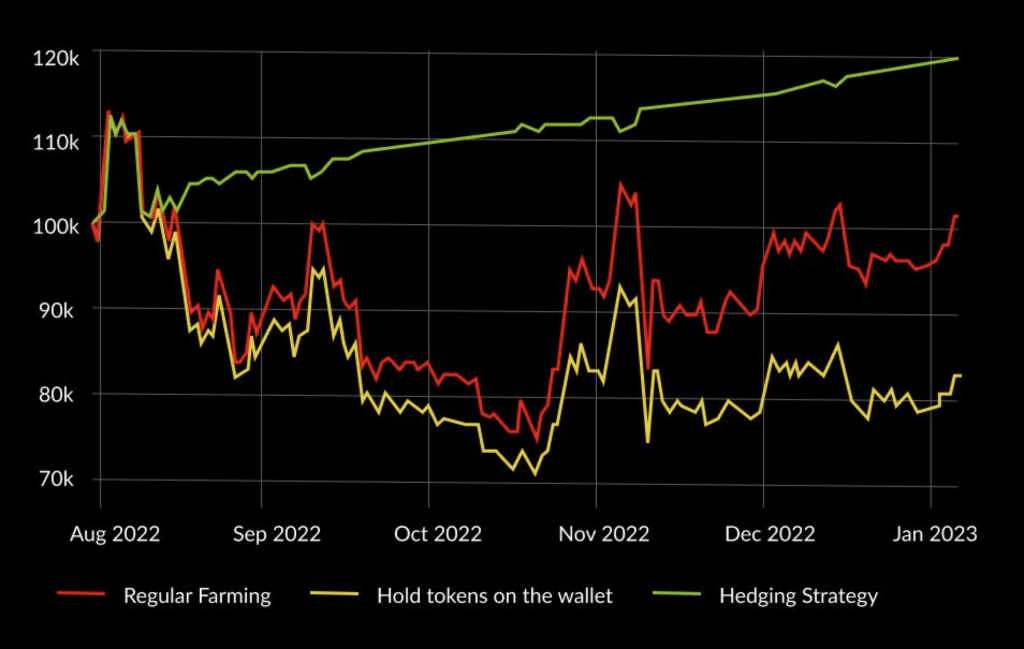

The next big thing we have been working on to show it on-chain – is our hedging strategy. Let’s review the historical backtests and describe the strategy’s algorithm below.

Here you can see a backtest from Aug 1, 2022 to Jan 6, 2023, using the USDC/OP pool on Velodrome. We started with $100,000 and compounded daily. The average APR during this time was 50.49%, according to Beefy’s historical data.

Use of our hedging strategy resulted in a 19.06% portfolio value increase (48.06% annualized), vs. a 0.66% increase (1.58% annualized) by providing liquidity to the pool, and a 17.6% decrease by holding 50% USDC and 50% OP. The strategy rebalanced 50 times, costing $1,010 and resulting in a net gain of just over $18K, or 18%, in just over 5 months.

Hedging strategy algorithm:

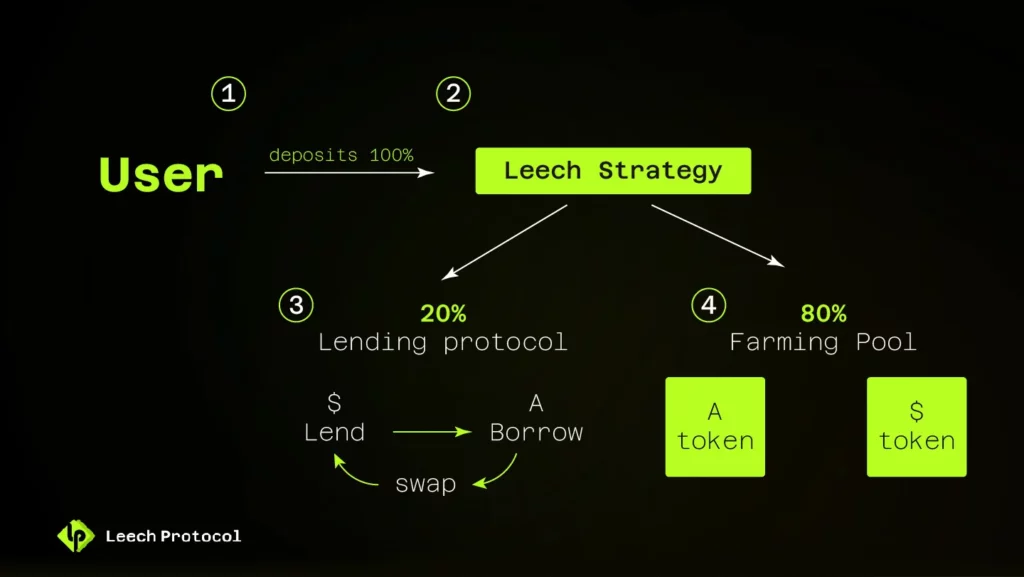

1 – the user provides his liquidity via our app

2 – smart contract starts managing the liquidity into

- 20% goes to open the short position via connected credit protocol/perp (leveraged)

- 80% goes to the specified farming pool

We automatically close the short position if the price goes up and rebalance it.

We are cooking the UNI v3 strategy for the Leech Club members only!

Uniswap v3 (CLMM) strategy allows you to hedge the impermanent loss and rebalance the position on any protocol that supports Concentrated Liquidity so that it always remains active. The strategy works on all EVM blockchains where Concentrated Liquidity Protocols are present. Moreover, the strategy works with narrow ranges, that allow generation of high returns on the underlying assets. Backtests showed a 70%+ return on the USDC/ETH pair on the Arbitrum chain and more than 150%+ on medium and low-liquidity assets.

Onchain results are really promising and we’ll be sharing more details with interested parties.

Mid-term plans

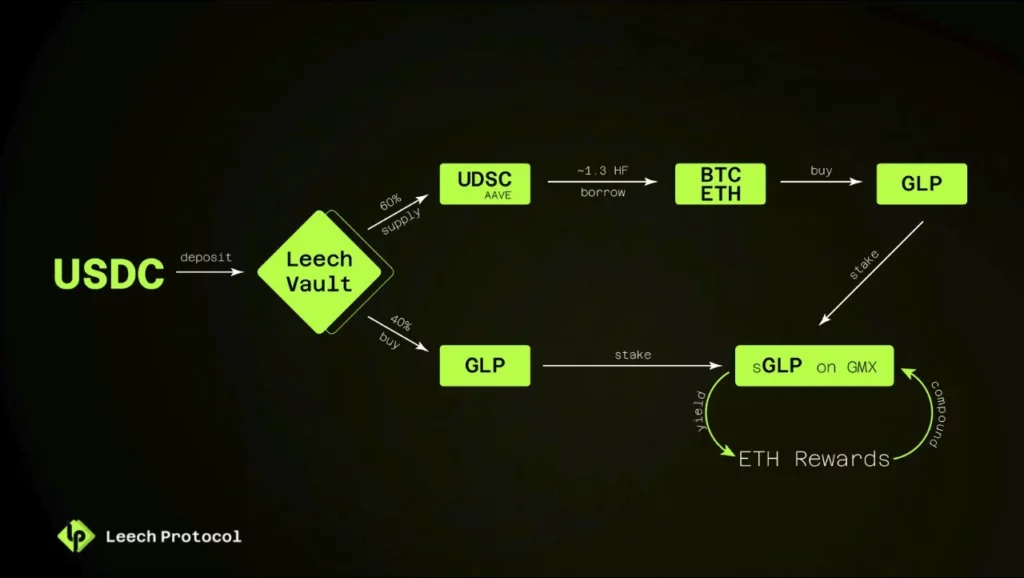

GLP neutral strategy

GLP-based strategies have a lot of potential despite the current market conditions. This strategy is also highly capital-intensive, and GLP’s utility ecosystem is constantly expanding. We forecast upcoming market conditions when this strategy will be able to accommodate a large TVL with probable returns of ~30% APR (as was previously during the volatile market).

- The user deposits into the vault

- 60% goes to GLP mint, 40% goes to deposit in AAVE

- On AAVE algorithm borrows ETH(50%) and BTC(50%) (with Health Factor of about 1.3)

- GLP is minted on BTC and ETH

- All GLP goes to staking in GMX

- Yield from GLP staking is compounded into GLP stake

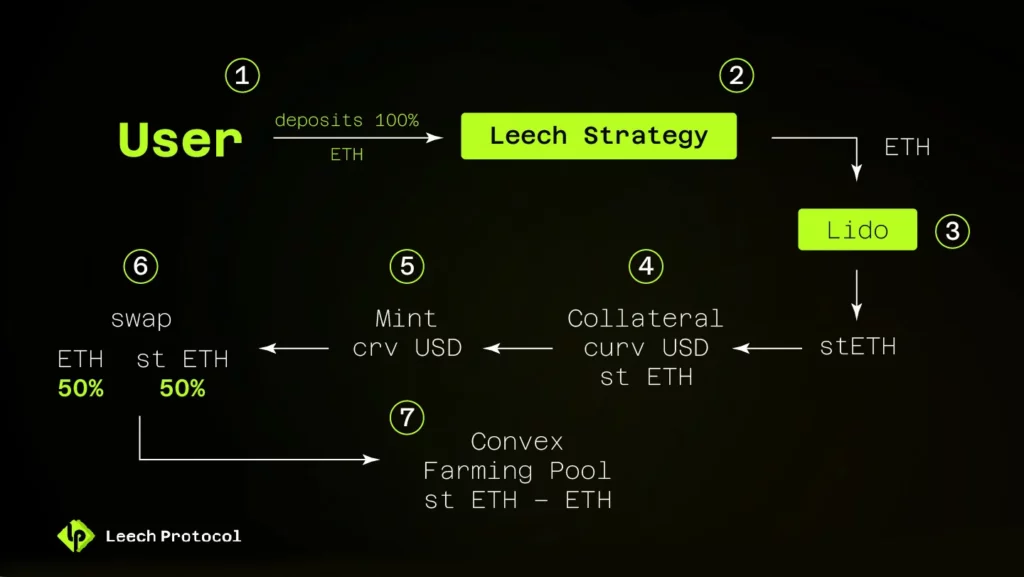

Lido Leverage Yield Farming Strategy

This strategy utilizes DeFi’s fundamental products and contains the underlying yield of the Ethereum network. It safely exploits the inefficiency between the underlying stake rate and the credit market rate.

- The user provides liquidity via our app

- Strategy (smart contract) operates liquidity

- Liquidity goes to Lido and gets stEth

- Collateral curv USD

- Mint crvUSD against stETH

- Swapping crvUSD for 50% stETH / 50% ETH

- Farming pool stETH-ETH

What should you do next?

- Try our automated cross-chain farming App

- Follow our Twitter for more DeFi and YieldFarming tips

- Join our Telegram for Daily Farming discussion

- Join our Discord to claim your roles and become early community member