Hurrah! It’s been a long time since we published any product updates!

Introducing Mixpool by LeechProtocol – less risk with high yields!

Help in Risk Management

Mixpools are divided into 3 levels of risk – High, Medium, Low, and one general mixpool.

- High-Risk Pool – the most profitable Mixpool where stablecoins with low capitalization or assets with borrowed funds (leveraged yield farming) can be used. The pool accepts products with our minimal risk requirements that have been evaluated by the LeechProtocol team.

- Medium Risk Pool – a balanced Mixpool in terms of the risk/reward ratio. It allows the use of assets other than BTC/ETH/USDC/USDT/DAI.

- Low-Risk Pool – the most conservative Mixpool, using high-cap assets and projects established as reliable in DeFi. It only utilizes BTC/ETH/USDC/USDT/DAI assets.

- General Mixpool – a shared Mixpool with the goal of optimizing returns between the three risk-graded Mixpools. For example, it may have a distribution like 70% in the low risk pool, 15% in the medium-risk pool, and 5% in the high-risk pool.

Full Automation

Full automation means not only auto-compound, but also position management and cross-chain deposits.

The user deposits liquidity into the selected mixpool, after which the deposit is allocated to vaults/strategies within this mixpool according to the weight of each element (vaults/strategies).

- Any integrated DeFi product in LeechProtocol and/or LeechProtocol’s own strategies can be added to the mixpool structure.

- Mixpool compositions are updated every epoch. There will not be a situation where an outdated product is included in the mixpool (decreased APR, removed incentives, new version of pool contract released, etc.).

So what happened?

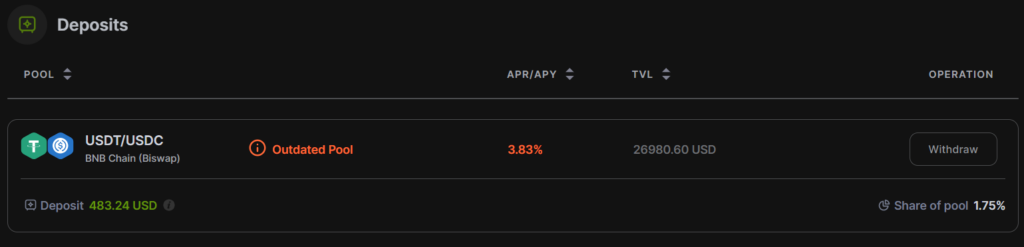

- Updated Pools: We moved to a completely new architecture of mixed pools! The pools that existed before are now considered “Outdated.” Users must withdraw their funds from these outdated pools and transfer them to the new ones. Note: Users who didn’t have funds in the pools before the update won’t see outdated pools; they’ll only see the new pool list. For users with funds in outdated pools, these will appear in their deposit list. Once they withdraw, the outdated pool will disappear from the page.

2. Rewards for Old Pools: Rewards for old pools (for this and previous epochs) are still accessible. Users can claim these rewards by clicking the ‘Claim reward’ button.

3. Rewards for New Pools: Rewards for the new pools will now operate through smartcontracts. The new epoch for pools will be set on Monday.

Frontend Changes:

- Updated pool list (as described above).

- Added a feature to visualize reward amounts for each new pool.

- Enabled reward claims for individual pools.

- Removed +25% APR/APY from outdated pools.

- Users with deposits in old pools will see an “Outdated pool” label, with an explanation and the option to withdraw only (no new deposits).

8th Incentivization EPOCH is LIVE

For those interested, boosted Yields for all our pools are Live!

- Claim Your Rewards: If you’ve provided liquidity during one of our previous incentivization epochs, it’s time to claim your well-deserved rewards! Your efforts are appreciated, and you can find the Claim button in the app.leechprotocol.com. Rewards will be sent to the BNB chain. Ask us any questions in our community chat!

- Boosted yields – 8th Epoch Details: Our 8th incentivization epoch for all pools (+25% APR per year) kicks off on Dec 21st and extends until Jan 4th. To be eligible for yields, you must provide liquidity for one or more pools at the app.leechprotocol.com.

- Withdraw Anytime: You can withdraw your liquidity at any time during the 6th epoch and be eligible for rewards in the proportion of days you provided liquidity.

- Details: While you can withdraw your liquidity at any time, 100% of rewards can only be claimed after the conclusion of the 6th epoch of incentivization. To claim 100% of rewards, you must have provided liquidity for the entire 14-day duration. If you provided liquidity for fewer days, the proportion will be applied (e.g., 5 full days of liquidity provision will entitle you to 5/14 of the total reward).

We are happy to assist you in EasyDeFi journey!

What should you do next?

- Provide liquidity via our farming App

- Follow our Twitter for more DeFi and YieldFarming tips

- Join our Telegram for Daily Farming discussion

- Join our Discord to claim your roles and become an early community member