Ways To Earn In DeFi

The main difference between DeFi (decentralized finance) and traditional finance is that DeFi provides trustless interaction between subjects. The role of an intermediary is played by a smart contract. This is the main difference that makes all the ways of earning in DeFi possible, which we will talk about below.

Today we will consider various ways of earning. The categorization is tentative, but we hope it makes it easier to understand DeFi’s capabilities. Some earning techniques may be repeated, but the mechanics will vary depending on the site/application. It is essential for us to understand the DeFi applications we are using, as different protocols earn money and allow us to profit in different ways. Let’s dive in.

DEXs

Decentralized exchanges (DEXs) are protocols that allow us to exchange one token for another. Trading on centralized exchanges is implemented through an order book. It correlates counter bids to buy and sell an asset. This is a good technology, but it requires a lot of resources. Making a fast, efficient, decentralized order book on a blockchain is difficult. So to solve the problem of exchanges in DeFi, another solution was found — Liquidity Pools and Automatic Market Maker algorithms (AMMs)¹. Liquidity Pools are liquidity buffers for making exchanges (there are many different types of liquidity pools, but the easiest to understand are pools containing two assets), and AMM is the name of the algorithm that defines the price of assets (without an order book or intermediaries). Now, let’s see how you can earn with these liquidity pools.

Providing Liquidity On DEXs

In order to make an exchange through a liquidity pool, there must be sufficient liquidity. In DeFi, any user can become a liquidity provider by adding his tokens to the pool and getting LP tokens in return, which will represent his share of the pool’s total liquidity.

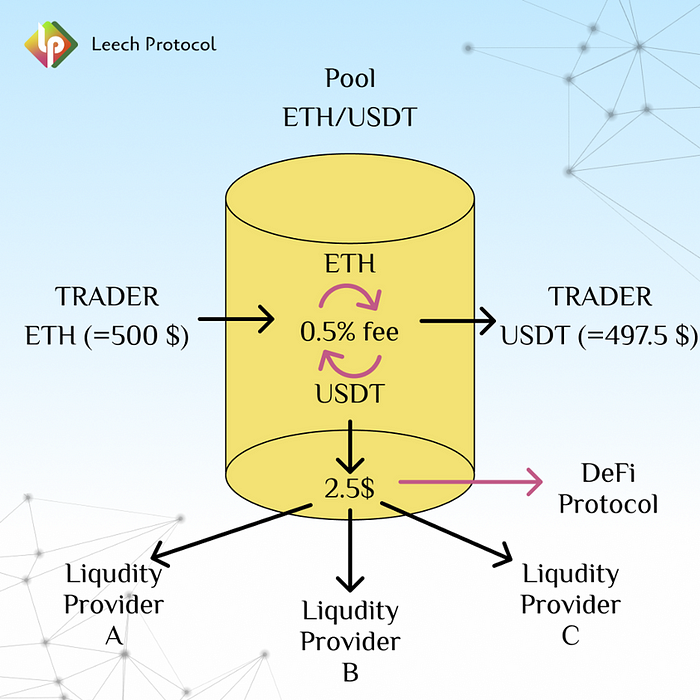

Let’s take the ETH/USDT pair as an example. The liquidity provider (which could be you) brings $1,000 to the pool. To put that into the pool, you would need $500 worth of ETH and $500 worth of USDT. If the current price of ETH is $1,250, that would be 0.4 ETH and 500 USDT. In this situation the liquidity provider creates a liquid pool of assets so that anyone can come and trade ETH for USDT or vice versa. In exchange for using this liquidity to trade, the trader pays a small fee (0.5% in our case) to the liquidity pool, which is distributed pro rata between everyone providing liquidity to that pool.

A list of Liquidity Pools at uniswap.org. Next to the name, you can see the trading fee of that pool displayed as a %, as well as the TVL or Total Value Locked (how much liquidity is in the pool), and the trading volume over the last 24 hours, and 7 days.

Providing liquidity is the most basic way of earning on DEXs (keep in mind that some portion of the trading fees goes to the protocol itself).

It is worth noting that Liquidity Providers are subject to a specific risk, called Impermanent Loss². When assets inside the pool are volatile in relation to each other, liquidity flows in favor of the cheaper asset. This is a controversial term, but before providing liquidity, you should definitely learn more about Impermanent loss.

Here are three main factors to consider when deciding whether to provide liquidity to a pool:

- How much trading volume does the pool have? Higher trading volume means more fees, and thus higher earnings for you;

- What percentage of the pool’s liquidity will you own? The more of the pool you own, the higher the percentage of the fees you will earn;

- The higher the volatility of the tokens in the pool, relative to each other, the higher the potential “Impermanent Loss”.

Farming on DEXs

Any new DEX protocol faces the problem of low liquidity and trading volumes. Exchanges with very low liquidity struggle to attract trading volume for many reasons. In order to attract liquidity providers to the DEX, protocols launch liquidity mining programs, which usually involve issuing the protocol’s own token. This strategy tends to work well, as it usually results in liquidity pools that can supposedly provide astronomical reward rates, such as 100,000% APR. This is effectively a marketing campaign, where the protocol dilutes itself in order to encourage liquidity providers to bring liquidity to the DEX. The liquidity providers then earn from trading fees and the liquidity mining program incentives.

This method of earning is generally referred to as farming.

The main problem with farming is that the price of the rewarded token usually plummets. Almost every DEX token has a steep downward price graph, since the token has no significant value other than being sold. As a result, the real APR tends to be quite low, even if the website shows a high APR.

As an example, let’s look at the new DEX camelot.exchange, where yields are calculated primarily by GRAIL/xGRAIL tokens at the current price. The xGRAIL token has a minimum lock-in period of 15 days, and it has fallen in price from $250 to $210 in recent days. The real APR here will be much less than what is shown in the interface. But even considering this, the protocol can for some time give returns higher than the average of their competitors.

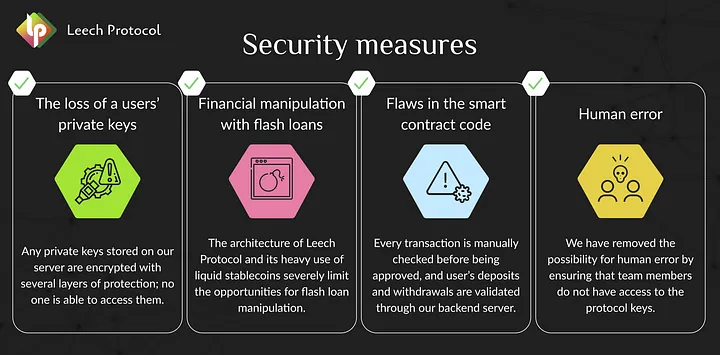

Yield Farming aggregators, such as Leech Protocol, help users farm more efficiently.

Farming is usually short-term and situational, and involves more risk, whereas income from trading fees is easier to predict and associated with the medium to long term.

Lending

Lending protocols open up the next layer of profitability in DeFi. These protocols offer you the ability to borrow various tokens against the collateral of other tokens, sometimes even NFTs. Here are the main things to know about borrowing from lending protocols:

- Loans have interest fees; you may have to pay back $1.02 after borrowing $1;

- If, because of price fluctuations, the ratio of your loan to your collateral becomes too high (usually >80%), then your collateral will be liquidated to automatically repay your loan;

- The amount you can borrow is limited, usually up to 80% of your collateral;

A model of the interactions with a Lending protocol.

Providing Liquidity On Lending Protocols

This is the most obvious way to make money from lending protocols. You can earn just by depositing an asset and not borrowing anything. Here, unlike liquidity pools, you only have to provide one asset to the protocol, and when that asset is borrowed, the protocol will share the loan’s interest payment with you.

You may also be able to find liquidity mining programs on lending protocols, which provide additional rewards to both depositors and borrowers.

An example of a liquidity mining program on the aurigami.finance protocol. The interest rate for borrowing USDC is 5.38% APR, but the protocol “pays” the borrower with its PLY tokens at a rate of 8.94%. So, if the price of the PLY token is relatively stable, the borrower will earn 3.56% APR.

Looping On Lending Protocols

This strategy can be enabled by the combination of liquidity mining programs and favorable interest rates on lending protocols. This mechanic can be called a special type of farming. To create a loop, you make a deposit to a lending protocol (for which you are paid the interest rate plus any liquidity mining incentives) and borrow an asset (for which you are charged an interest rate) and, if done correctly, you will have a net positive total return. In this case, you can repeat the cycle up to 10–20 times (actually infinitely, but at some point the price of gas will simply become more expensive for you than the potential benefit) and significantly increase your income. Such are the wonders of the DeFi world. The main thing is not to forget to claim the liquidity mining rewards.

In the example, we mentioned above with aurigami.finance, you can implement such mechanics by farming for PLY tokens. But note that there is an unlock period for rewards.

Increase Capital Efficiency With Lending Protocols

The main function that DeFi lending protocols perform is increasing capital efficiency.

Suppose you have 10 BTC and 100 ETH and you believe in the growth of these assets, so you hold them until the next bull market. However, in DeFi, income opportunities are always appearing. In this case, you can deposit your 10 BTC and 100 ETH and borrow 100k USDT to put into a conservative farming strategy, getting an additional 10–20% APR on that 100k USDT. Now your BTC and ETH are generating returns instead of lying idle waiting for a bull market. To get all of your assets back, you will need to return 100k USDT plus any interest fees owed to the protocol.

An example with venus.io protocol. Here, we are getting a loan in BUSD, secured by ETH, BTCB, BNB. In this case, the collateralized assets would need to fall in value by more than 50% for there to be any liquidation risk. In this case, the user received liquidity in the amount of 34% of his assets, which he can use further in his strategy.

Using Lending Protocols To Long/Short

Lending protocols allow you to borrow many more types of assets than just stablecoins. Therefore, we have the ability to take long or short positions on the assets available on a lending platform. Suppose you go long on BTC. In this case, you will deposit your BTC, use it as collateral to borrow stablecoins, use those stablecoins to buy more BTC, which you then deposit again to use as collateral, and so on. This will allow you to build leverage, and if the price of BTC increases, you will only need to take some profit to zero out your position.

Shorting works similarly, except that you will deposit stablecoins, borrow BTC, sell it for more stablecoins, and repeat.

You don’t necessarily have to use stablecoins to do this, as you could take a long or short position on an altcoin relative to another altcoin.

Liquidations

In lending protocols, you can also make money as a liquidator by buying out the loans of borrowers whose collateral has fallen below the required collateralization threshold. Such liquidations will be carried out for you at a discount to the current market price, and you can sell the asset immediately for a profit.

Note that in the vast majority of cases, you need to have programming skills to participate in liquidations through a normal lending protocol. But there are protocols that allow you to participate in liquidations through ready-made interfaces, such as liquity.org or orca.kujira.app.

An example of the orca.kujira.app protocol. Here any user can choose the discount % with which he wants to liquidate a position in ATOM token, leaving a deposit (in USK stablecoins) to carry out the liquidation.

Options

DeFi options trading does not differ much from its counterpart in the traditional market. An option is the right to buy or sell a certain asset at a specified price at a specified period/day. Put and call options of American and European types are common in DeFi. In DeFi options markets, you can trade, provide liquidity, earn premiums, and hedge your positions.

Let’s say you bought a call option to buy 1 ETH with strike price at $1,250 that will expire in 7 days. The price of such an option (this is called the “premium”) for you will be $50. Seven days later, the price of ETH is $1,800. You use your right to buy 1 ETH for $1250 and sell it at market price, making $500 of profit ($1,800 — $1,250 — $50).

Trading Options

The most obvious way to use options for profit is to buy calls and/or puts. You buy the options based on your expectations of where prices will go, and you end up earning by correctly predicting the future prices of assets. The main difference from regular trading is that options have a strike-price restriction on their execution. However, in case you mispredict the price, you only lose what you spent on the option premium.

An example of an interface for options trading on the hegic.co protocol.

Providing Liquidity On Options Markets

As you have already understood, providing liquidity in DeFi is a very common source of income. DeFi has no centralized sources of liquidity, and they need it to offer financial products. Options are no exception. In order to trade options, liquidity is required. Options protocols share commissions, premiums and their tokens with liquidity providers.

Options protocols can be very different from each another in terms of liquidity mechanics, but more often than not they “pack” liquidity into specific strategies and allow liquidity providers to participate in those strategies.

An example of liquidity strategies on the opium.finance protocol.

Perpetual Markets

Futures trading on decentralized exchanges is gaining popularity, which is not surprising, because this type of exchange provides margin trading with leverage of 100x or more. While trading is simple, providing liquidity on futures exchanges is more complicated.

Providing Liquidity On Perpetual Market Protocols

As with options protocols, the difference between liquidity mechanics between perpetual protocols can be significant. However, as a rule, the liquidity provider’s profitability directly depends on the success of traders. If traders suffer losses, the liquidity provider earns, and vice versa. This is also true for liquidity providers of the well-known gmx.io protocol. There are many studies which tell us quite unambiguously that in the long term traders lose money. Therefore, the liquidity provider should be ready to see a possible short term decrease and long term increase of his funds in the pool.

Example of a cap.finance protocol. The profitability of pools directly depends on the results experienced by traders.

Staking

In DeFi, you will often encounter the concept of “staking” with different yields. It is important to distinguish between staking the native token of a Proof-of-Stake (PoS) blockchain (delegating to validators) and any other kind of token staking.

Staking (PoS)

Staking the native token of a PoS blockchain is probably the safest (at the blockchain level) way to generate returns. You delegate your coins to network validators, and in return, receive a portion of token inflation. The validators cannot move your coins in any way. It is similar to a typical deposit in a bank, though staking returns often outpace inflation, quite unlike the returns given on fiat deposits by real world banks.

Staked tokens usually have an unlock period. This means that when you request your tokens back, you will have to wait for a period of time before they become available to transfer. This period can be a couple of days or a couple of weeks; it is different for each blockchain. Of course, you will know in advance what unlock period awaits you.

An example of ATOM coin staking in the Kepler wallet interface. At the bottom you can see the network validators that are being staked to. Just above that, on the right side, are the claimable rewards that are available for withdrawal.

Liquid Staking

In DeFi, a rather strong driver of TVL growth is liquid staking. The logic is very simple — the protocol that provides the liquid staking takes your underlying asset and delegates it to the network validators. In return, the protocol issues you a derivative (=”liquid asset”) in a 1:1 ratio with the underlying and a guarantee (in the form of a smart contract) that by providing the liquid asset, you will receive your underlying + the accumulated yield for staking. Where does this yield come from? Staking the underlying asset generates a yield to the liquid stacking protocol and the protocol accumulates this yield in the price ratio between the underlying asset and the derivative. Over time, for 1 derivative, you can get >1 underlying asset, considering the accumulated yield.

The main function of liquid staking is to free up your capital that is in staking. You can use the liquid asset in DeFi — trade it, borrow against it, provide liquidity, etc. Liquid-staking protocols are usually simple and secure, but hacks can happen here, too.

Example of Liquid Staking on lido.fi, where the liquid asset stETH (with the underlying asset ETH), generates about 4.8% APR.

Protocol-Level Token Staking

Protocol-level token staking is usually considered a part of tokenomics. It effectively lowers the circulating supply by locking up tokens, and increases token’s utility. Often, protocols will distribute part of their profits to stakers of the protocol’s token. In general, each case of token staking has to be considered separately. This method of staking can be riskier, but can provide higher returns.

Example of protocol-level token staking using the gmx.io protocol. Their GMX token can be staked and you can receive part of the protocol’s revenue in ETH and AVAX tokens, as well as part of the Escrowed GMX. GMX staking also gives multiplier points for rewards.

Arbitrage

This method stems from a variety of factors that are peculiar to DeFi at its current stage of development. However, it is necessary to understand the basic point. Due to the large number of DEXs in existence, there can be many separate liquidity pools for trading the same asset. Due to individual trades only occurring on a single DEX at a time, the prices of assets are rarely equal across platforms. This presents the simple opportunity of buying an asset where it is cheaper, and selling it where it is priced higher.

Arbitrage opportunities occur most often in moments of high market volatility due to large liquidations, hacks, scams, or just big systematic failures. Some algorithmic stables have arbitrage mechanisms built into their design in order to help them maintain their price pegs.

The vast majority of arbitrage opportunities are only available if you are good at programming, but that doesn’t mean that you can’t arbitrage successfully without programming skills.

Successful arbitrages may include different DEXs, lending protocols, CEXs, blockchains, and bridges. If you want to understand DeFi arbitrage from scratch, you should start by studying real cases. ³

Simplified arbitration scheme between DEXs.

Vaults

Vaults are the automation of DeFi strategies in a user-friendly interface. Technically, vaults are an add-on to smart contracts, where the logic is prescribed. With vaults, you can combine the different protocols and mechanics we discussed above.

Schematic example of a vault with an auto-compound function while farming on a DEX. Here, the tokens received as rewards are automatically exchanged for the two tokens used in the liquidity pool, and added to the pool. In this way, we increase the profitability of farming.

Vaults greatly simplify user interaction with DeFi. Leech Protocol creates such vaults.

What should you do next?

- Provide liquidity via our farming App

- Follow our Twitter for more DeFi and YieldFarming tips

- Join our Telegram for Daily Farming discussion

- Join our Discord to claim your roles and become an early community member

¹ What Are Automated Market Makers (AMMs) https://blog.chain.link/automated-market-maker-amm/

² Impermanent Loss Explained https://academy.binance.com/en/articles/impermanent-loss-explained

³ Twitter thread — How I turned $1500 into $17,862 in under 17 hours arbitraging cryptocurrencies https://twitter.com/omgitsinfy/status/1555912558980509696