How to calculate true APR/APY?

Today we’re gonna talk about two important metrics – APR and APY. We’ll go over what they are, how and when to calculate them, and most importantly, how to use them to make smart farming decisions. Because let’s face it, when it comes to farming, it’s all about those “percentages”!

Table of Content:

- Base. What is APR and APY?

- Calculating APR (Annual Percentage Rate)

- Calculating APY (Annual Percentage Yield)

- What you need to understand about APR and APY

- Calculating the “true” APR and APY

- Calculator APR/APY

Base. What is APR and APY?

APR and APY are widely used in DeFi to help us understand the potential return we can earn by providing liquidity. Both metrics represent annual interest rates and are essentially forward-looking metrics. They are useful for predicting the potential returns we can earn from various investments. Here’s what each of them means:

APR (Annual Percentage Rate) is the annual interest rate that is applied to the invested assets.

APY (Annual Percentage Yield) is the annual interest rate that is applied to the invested assets, taking into account compound interest and other factors that affect the overall return.

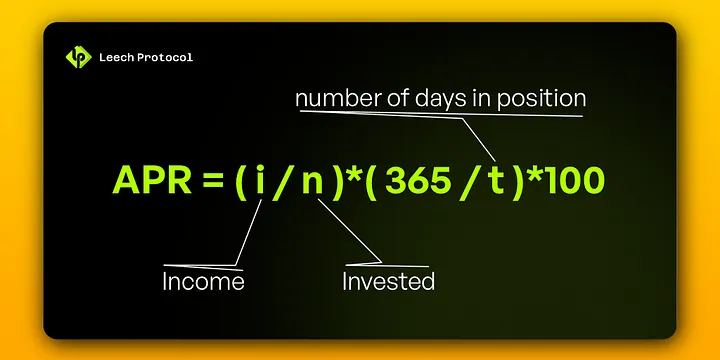

Calculating APR (Annual Percentage Rate)

This is a basic metric for evaluating the profitability of a liquidity pool/asset/strategy. The main feature when calculating APR in DeFi is the strong fluctuations in parameters that affect profitability (TVL, volumes, fees, rewards per block, etc.). Therefore, sometimes to understand the “fairness” of APR, we need to look at the dynamics of these parameters.

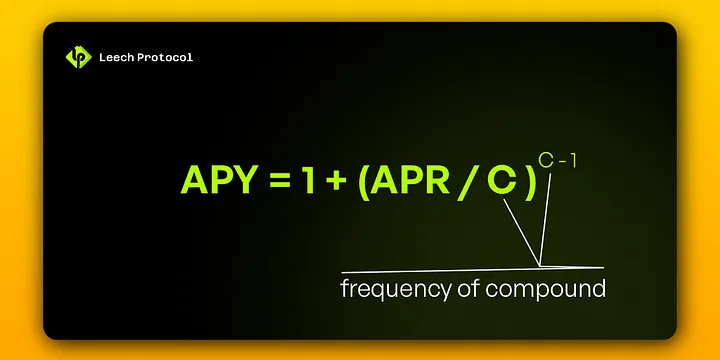

Calculating APY (Annual Percentage Yield)

APY can be thought of as APR with a compounding function. This metric shows us the annual return taking into account reinvestment of the earned interest. It can be calculated differently from project to project. However, if you know your APR, you can easily calculate your APY.

In summary, the difference can be presented as follows:

- APR shows the annual percentage return on investments

- APY shows the annual percentage return on investments + compound interest

What you need to understand about APR and APY:

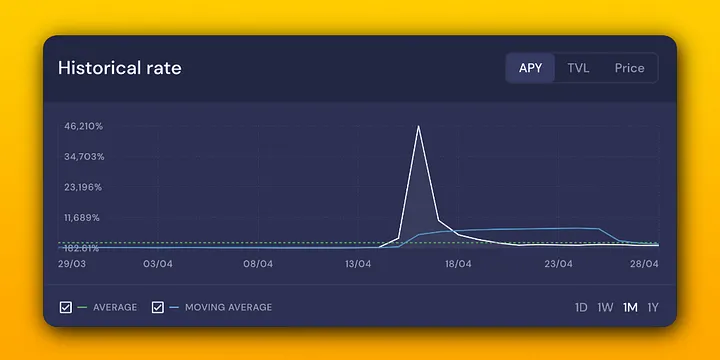

1. APR and APY are calculated based on historical averaged data. In such a volatile market like crypto, extreme values can lead to statistical errors. In just one day, we can see pool volumes increase by hundreds or thousands of times, while the next day everything returns to previous values. Take a look at the screenshot of such a vault.

2. APR/APY are manipulative metrics in DeFi, with no standard for their calculation. Protocols are naturally interested in showing a high percentage. What tricks could be used in their calculation?

- Calculation based on rewards in locked tokens;

- Calculation based on a short period of time with extrapolation to a longer period;

- Inclusion of extreme high values in the calculation;

- Calculation with compound interest, even when the protocol doesn’t have such functionality;

- You can write your own versions in the comments, which ones you have encountered.

3. APR and APY are measures of profitability that do not take into account changes in the value of the underlying asset. Therefore, it is easy to see high APRs but suffer losses from a decrease in the value of LP tokens/tokens.

But despite the fact that APR/APY have their peculiarities in DeFi and can significantly overestimate expectations, they still give us an understanding of the product’s profitability.

Calculating the “true” APR/APY

In reality, there is no “true” APR and APY. Any approach to calculating these metrics will be a simulation of future profitability. However, by delving into the model of generating profitability for a particular pool, you can choose a suitable approach to calculate these metrics – and this will be the most “true” APR/APY for you, as it will take into account your specific strategy parameters.

Calculator APR/APY

We have created a simple calculator for you in the form of a Google Sheet, which will help you calculate what income you can expect from different pools with various parameters. In it, you can also calculate the result with top-ups.

Just make a copy of the table and use it👇

Leechprotocol | Calculator APR/APY

What should you do next?

- Provide liquidity via our farming App

- Follow our Twitter for more DeFi and YieldFarming tips

- Join our Telegram for Daily Farming discussion

- Join our Discord to claim your roles and become an early community member